What a roller coaster this Q1 2020 had been. Shortly after my previous post about my bonus letter, the stock market started to tumble – and by tumble I mean falling off a cliff! I was very tempted to buy in at the “dips”, but the negative news kept coming which pushed the markets even lower. In the end, except for my dollar-cost averaging strategy, I made zero transaction over this period.

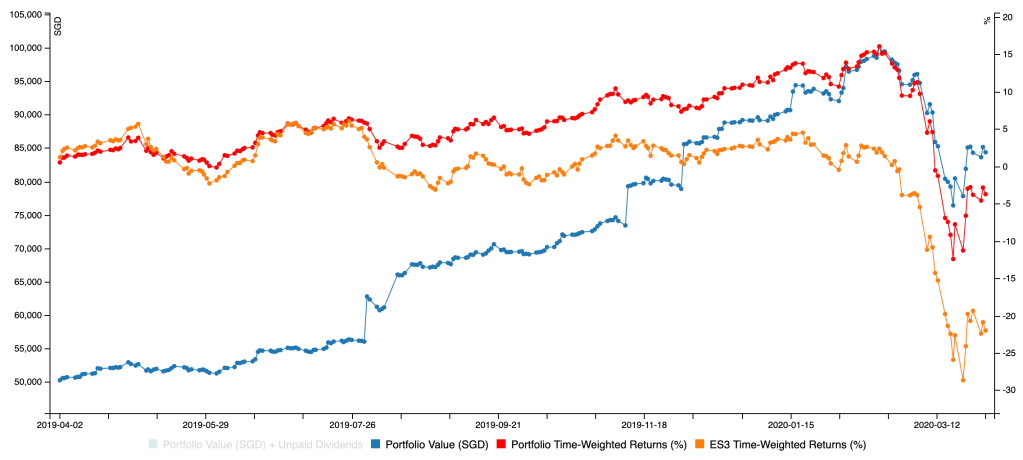

As of today, I have lost about S$13,000 on paper. My gains over the past few years of investing have been completely wiped out and I am sitting on paper losses of about S$3,000. Had I panic sold at the recent bottom (before news of the US economic stimulus package was announced), I would have realised losses of about S$15,000.

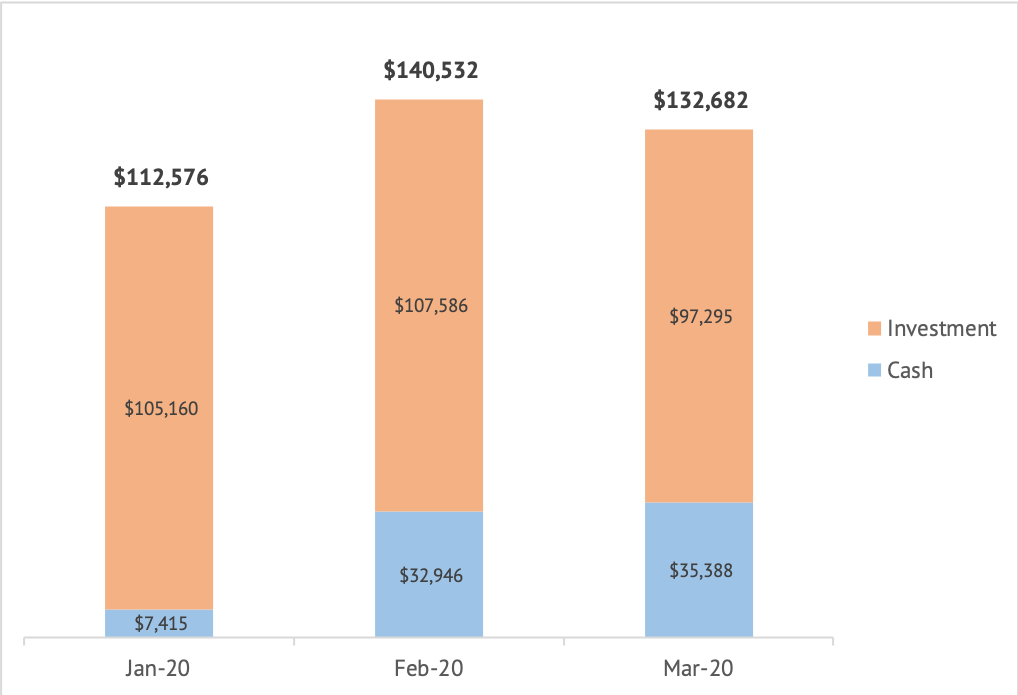

My net worth as of Q1 2020 is S$132,000. Had the 2 black swan events not happened (COVID-19 and oil price war), I would have ended Q1 2020 with a net worth of ~S$145,000. In other words, my savings progress has been delayed by ~5 months.

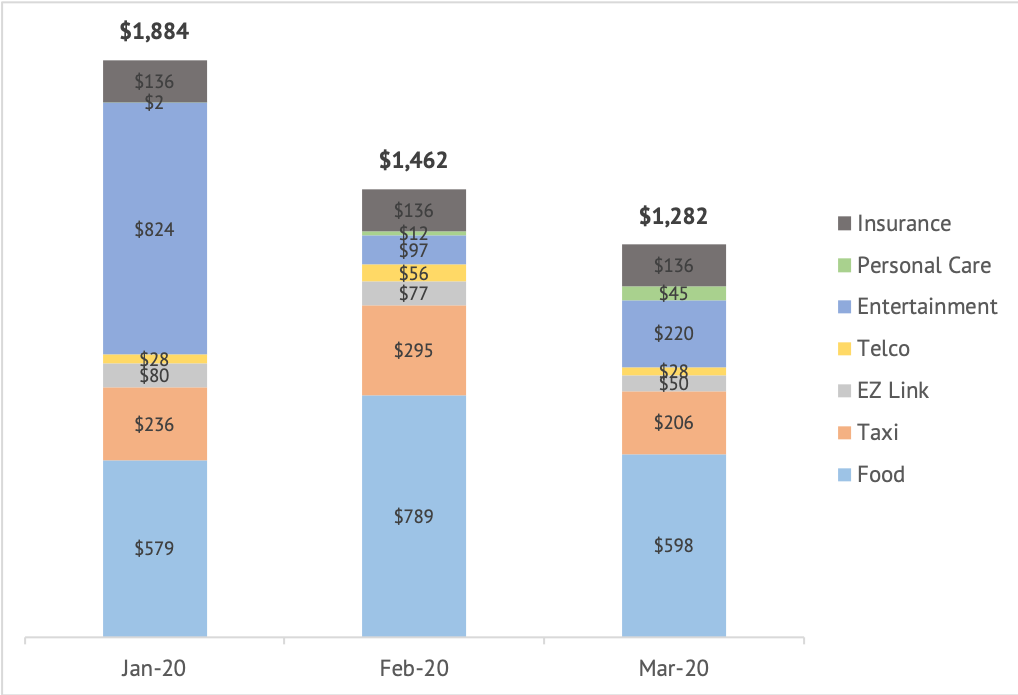

As I am still working from home, my spending in March has been significantly lower compared to January and February (big thanks to my mum who takes care of the meals at home!).

Hindsight is indeed 20/20. I can only imagine selling everything when COVID-19 news first surfaced and buying into a leveraged inverse S&P 500 ETF! Looking ahead, I will sit on the sidelines as nobody can call the market bottom. We are truly in a very historic moment where demand sinks and supply chains falter.

I hope all readers stay safe and act responsibly! We can still be productive during this stay-home period, like re-connecting with our loved ones, trying new activities (cooking, home workouts) or even watching a (or a few) new series on Netflix. I remain optimistic about the future and believe we will get through this dark period in time to come.